3 min read

Emerging Trends in Cryptocurrency: The SEC’s Influence on Spot Bitcoin ETFs

In what has been a momentous year for the cryptocurrency market, the United States Securities and Exchange Commission (SEC) has been at the center of attention, especially with leading asset management companies like BlackRock and others filing for Spot Bitcoin Exchange-Traded Fund (ETF) registration. A Spot Bitcoin ETF would track the market price of Bitcoin, giving investors exposure to Bitcoin without having to buy the currency. Although these applications haven’t yet been approved, the industry is closely monitoring the SEC’s actions, which are crucial for the current $1.4 trillion global cryptocurrency market capitalization.

SEC’s Evaluation and Decision Timeline Extends into 2024

The SEC’s acknowledgment of Spot Bitcoin ETF registration applications from BlackRock and other firms marks a significant step in Bitcoin’s integration into conventional financial products. Nevertheless, the final approval for these ETFs is still pending as the SEC continues its evaluation and decision-making process until 2024.

Grayscale’s Legal Challenge Against SEC: A Turning Point in the Debate Over Cryptocurrency ETFs

The U.S. Securities and Exchange Commission has consistently rejected applications for Spot Bitcoin ETFs, primarily due to concerns about fraud risks. However, this stance may shift following a legal loss in August. Grayscale Investments, a key player in the cryptocurrency market, has been at the forefront of this change. The company’s efforts to convert its Bitcoin trust into an ETF were initially rejected by the SEC. In response, Grayscale filed a lawsuit against the SEC. The case progressed, and in late August, a federal appeals court criticized the SEC for not adequately justifying its refusal of Grayscale’s Bitcoin Spot ETF application, marking a potentially pivotal moment in the ongoing debate over cryptocurrency ETFs.

SEC Decisions on Spot Bitcoin ETFs and Their Global Impact

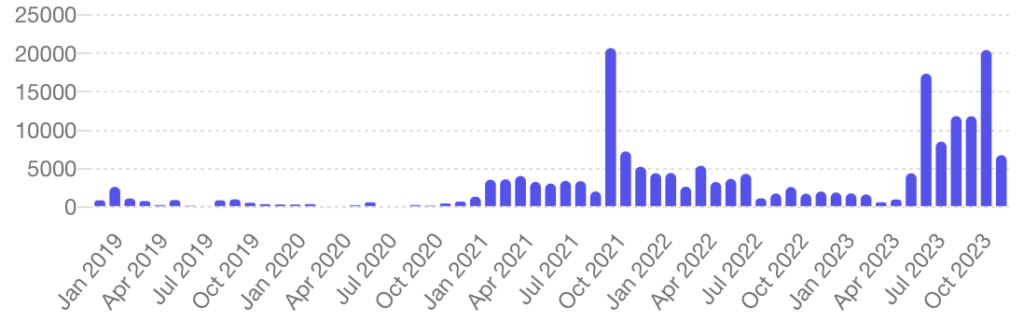

The idea of a Spot Bitcoin ETF first gained prominence in the cryptocurrency community in 2021 and has been a subject of increasing interest since June 2023. Semantic Visions’ analytics revealed a surge in discussions about this topic, with a peak in October when over 20,477 articles focused on the Spot Bitcoin ETF. Semantic Visions‘ Search tool, which covers about 90% of online news in 12 major languages, underscores this growing interest in the below chart.

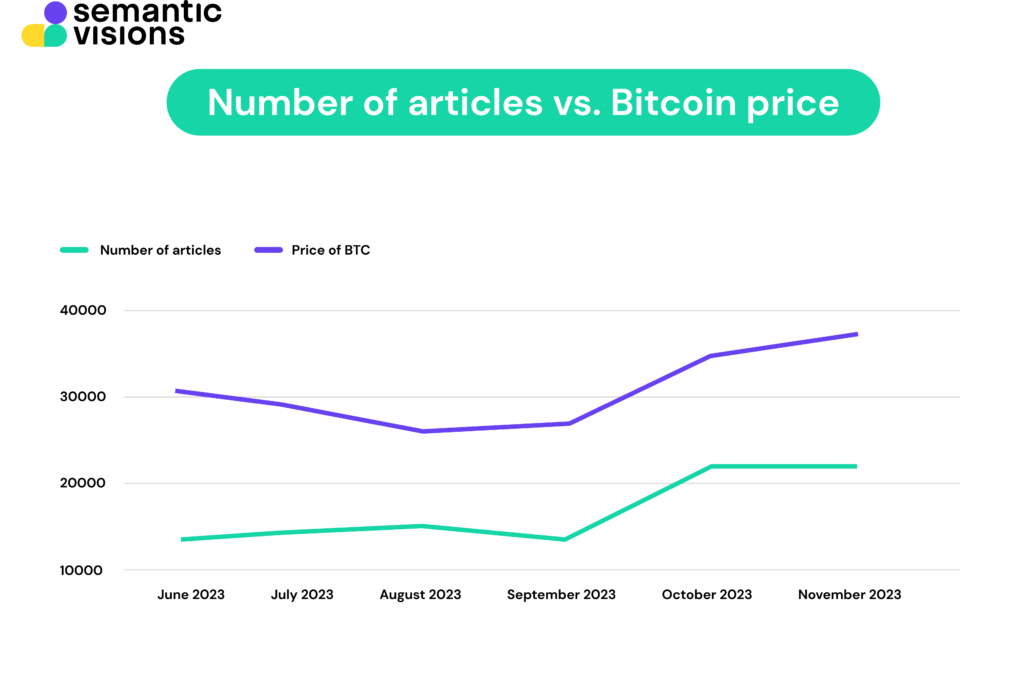

In the time period from June 2023 to November 2023, we observed the Bitcoin price and the number of articles detected by our company.

The wait for an SEC-approved Bitcoin ETF continues to be a source of anticipation and speculation within the cryptocurrency market. While the global financial community takes decisive steps towards embracing cryptocurrency, it’s the SEC’s cautious, yet potentially precedent-setting decisions that will ultimately pave the way for the future of cryptocurrency investment in the United States. These decisions are keenly awaited by the SEC and may also set a benchmark for regulatory bodies worldwide, signaling a pivotal moment for the industry’s growth and its acceptance into the mainstream financial ecosystem.

Our cutting-edge AI makes it possible to accurately structure unstructured data, understand the semantics of texts in multiple languages, and make predictive analysis based on these data. To learn more about Semantic Visions’ event-detection capabilities or for a free demo, send us an email at sales@semantic-visions.com.