6 min read

Exploring the Transformative Power of ESG Indexes

ESG indexes have become critical benchmarks within the investment arena, steering investors towards businesses that are not only financially robust but also adhere to sustainable and ethical practices. However, the benefits of achieving high ESG scores extend well beyond attracting investors. Companies demonstrating well ESG performance may secure more favourable conditions on bank loans. Additionally, in an era where organizations increasingly evaluate the sustainability and ethical standards of their supply chains, a robust ESG performance offers a strategic advantage. As a result, companies not only ensure compliance with global sustainability standards but also significantly reduce their risk of supply chain disruptions caused by environmental disasters or labour disputes.

In response to the market developments, Semantic Visions has embarked on a proactive approach. We are proud to unveil our own ESG Index, aimed at contributing positively to the ongoing dialogue within different industries. By leveraging and monitoring over 220,000 distinct domains in 12 different languages, our scoring system provides a representation of the media perception regarding a company’s sustainability efforts. This approach not only highlights areas of excellence but also identifies areas for potential improvement.

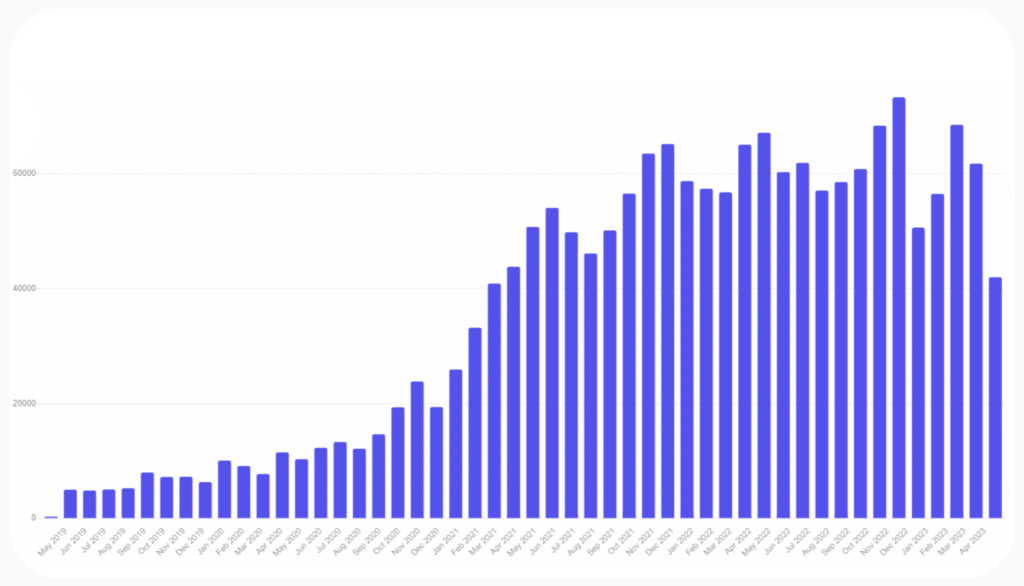

Global ESG trending since May 2019

Origins of ESG Indexes:

An ESG index is constructed by selecting companies based on predefined environmental, social, and governance criteria. Scores are generated by rating platforms through analyst evaluations of corporate disclosures, management interviews, and public information, providing investors with a benchmark for assessing sustainability performance.

The history of ESG traces back to the early 21st century, when a growing recognition of sustainable investing’s importance began to take shape. The launch of the Dow Jones Sustainability Index in 1999 marked a significant milestone, establishing one of the first global indexes to track companies based on their sustainability performance. Today, there are hundreds of ESG indexes that range from broad-based ones that cover multiple sectors and regions to niche indexes focusing on specific themes such as climate change, gender diversity, or renewable energy. These trends of prioritizing ESG metrics reflect a larger shift in the corporate landscape, where adopting sustainable and responsible practices goes beyond moral obligations, becoming key strategic decisions that can significantly impact a company’s trajectory and market success.

Parallel to the rise of ESG indexes, the investment industry has seen substantial growth, with the current value of assets managed worldwide estimated at over US$42 trillion. Significant contributions to this total include pension fund investments in the US and the UK, which amount to around US$7.4 trillion, and the global mutual fund industry, which accounted for $14 trillion in assets under management by the end of 2003. This financial landscape underscores the significant role that ESG considerations play in the broader context of global investment strategies.

Mainstream Adoption and Performance:

Despite the impressive advancements in the field of ESG indices, it’s essential to be mindful of the challenges they bring. A primary concern lies in the absence of uniform standards for ESG metrics, leading to discrepancies in company evaluations. This results in a scenario where different ESG indices may attribute varied scores to the same companies. It is important to underscore the findings of numerous studies that have demonstrated the potential for ESG-focused strategies to outperform financially, effectively dispelling the myth that investors must forgo returns to ensure their portfolios align with sustainability objectives. For instance, research conducted by MSCI revealed that companies with robust ESG profiles tend to display higher profitability and diminished risk over the long term compared to their counterparts. Given the significance and complexity of this topic, we will dedicate our next blog post to a more detailed examination.

Additionally, the potential for “greenwashing,” where companies may overstate their sustainability practices to score favourably on these indexes, poses a risk to the credibility of ESG assessments. Thankfully, both challenges will soon be regulated by EU directives (i.e., Green Claim Directive, ESMA Regulation). Thus, it’s vital to apply a critical lens when using ESG indexes, acknowledging their limitations and the importance of rigorous, independent analysis to ensure they truly contribute to positive change.

Our approach:

Considering the highlighted challenges, and following thorough research, Semantic Visions has recognized that we have the potential to enhance the existing landscape of ESG indices. In response, after months of development, we came up with our Semantic Visions’ ESG Index. Leveraging and monitoring over one million news articles from more than two hundred thousand distinct domains in 12 different languages, our scoring system stands out. The index not only provides insights derived from media perceptions but also adds a layer of validity to ESG assessments by offering both historical screening (up to five years back in time) and near real-time, relevant information. Moreover, unlike other indexes primarily reliant on ESG data provided by companies themselves or by third-party entities, our Semantic Visions’ ESG Index offers a unique perspective: it reflects media perceptions regarding a company’s sustainability efforts. This enables proactive mitigation measures to safeguard your reputation and financial performance.

Furthermore, our index with traditional due diligence enhances insights into suppliers’ reputations and behaviors, facilitating assessments of alignment between their ESG practices and your sustainability goals. Distinguishing ourselves from the competition, we commit to a methodology characterized by complete transparency. Our goal was to formulate a straightforward equation to facilitate our customers’ easy comprehension of the materials provided.

By utilizing a proportional scoring system — where the number of positive events is divided by the total number of events in each category, we are able to offer precise assessments of companies across four distinct levels of ESG score detail. The greater the ratio of positive events, the higher the resulting score, and conversely, a lower ratio of positive events will lead to a lower score. Additionally to ESG scoring, you may also be interested in analyzing long-term trends. For instance, by monitoring in near real-time, you can detect dips in long-term trends, allowing for proactive measures to be taken before significant damage occurs (e.g., protect company brand). Finally, thanks to our capability to break down data into specific categories, our index can be a helpful tool for the company’s double materiality, which is the first step in mandatory EU CSRD reporting.

Potential customers have the opportunity to request a demo of our comprehensive report, offering an extensive overview of the Semantic Visions ESG Index and detailing its features, methodologies, and findings. It also includes a step-by-step demonstration of our procedures and progress.